Powering the Future

of Small-Business Lending

Bank313 and Calibo have joined forces to build an AI-driven lending platform that delivers speed, transparency, and inclusion for small businesses in Detroit — and beyond.

A New Model for Community Banking

Traditional lending has long been slow, paper-heavy, and biased toward large borrowers.

bank313, powered by Calibo, changes that.

Built on Calibo’s governed orchestration platform, the bank313 Lending Platform unites digital onboarding, data-driven underwriting, and human oversight into a seamless experience — enabling community banks to approve loans in days instead of weeks.

“Our strategic alliance with Calibo allows us to streamline loan processes, making credit more accessible to small businesses and supporting economic growth. We chose Calibo because of their proven track record in digital innovation and their commitment to speed, efficiency, and trust.”

Robert Farr

President & CEO, First State Bank and Bank313

How the Calibo Lending Platform Works

From onboarding to decisioning, every step is digitized, governed, and designed for human + AI collaboration.

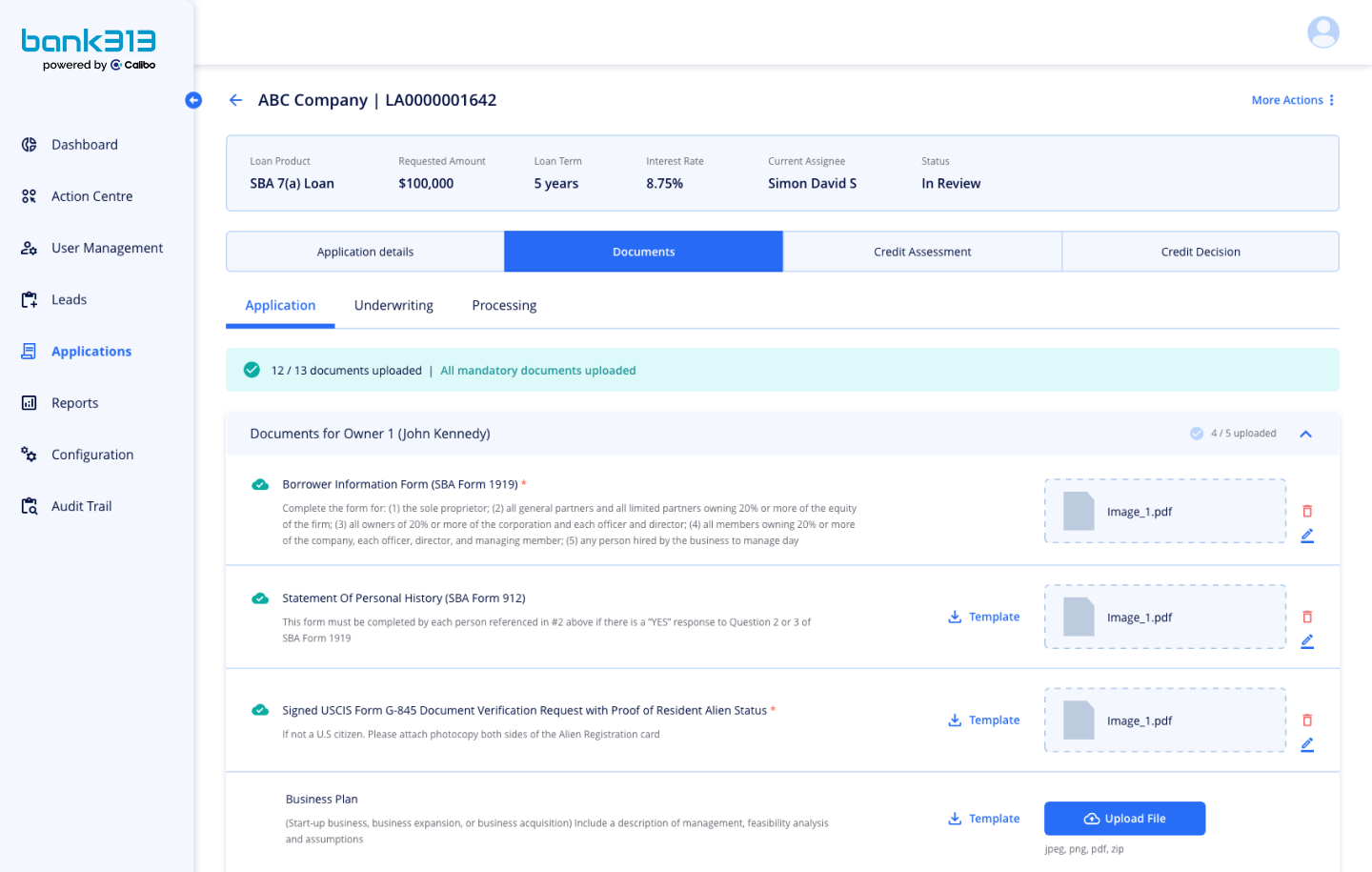

Digital Onboarding

- Borrowers apply online through a fully digital, paperless process.

- Built-in KYC and document verification streamline approvals.

- Omnichannel access for both bankers and business owners.

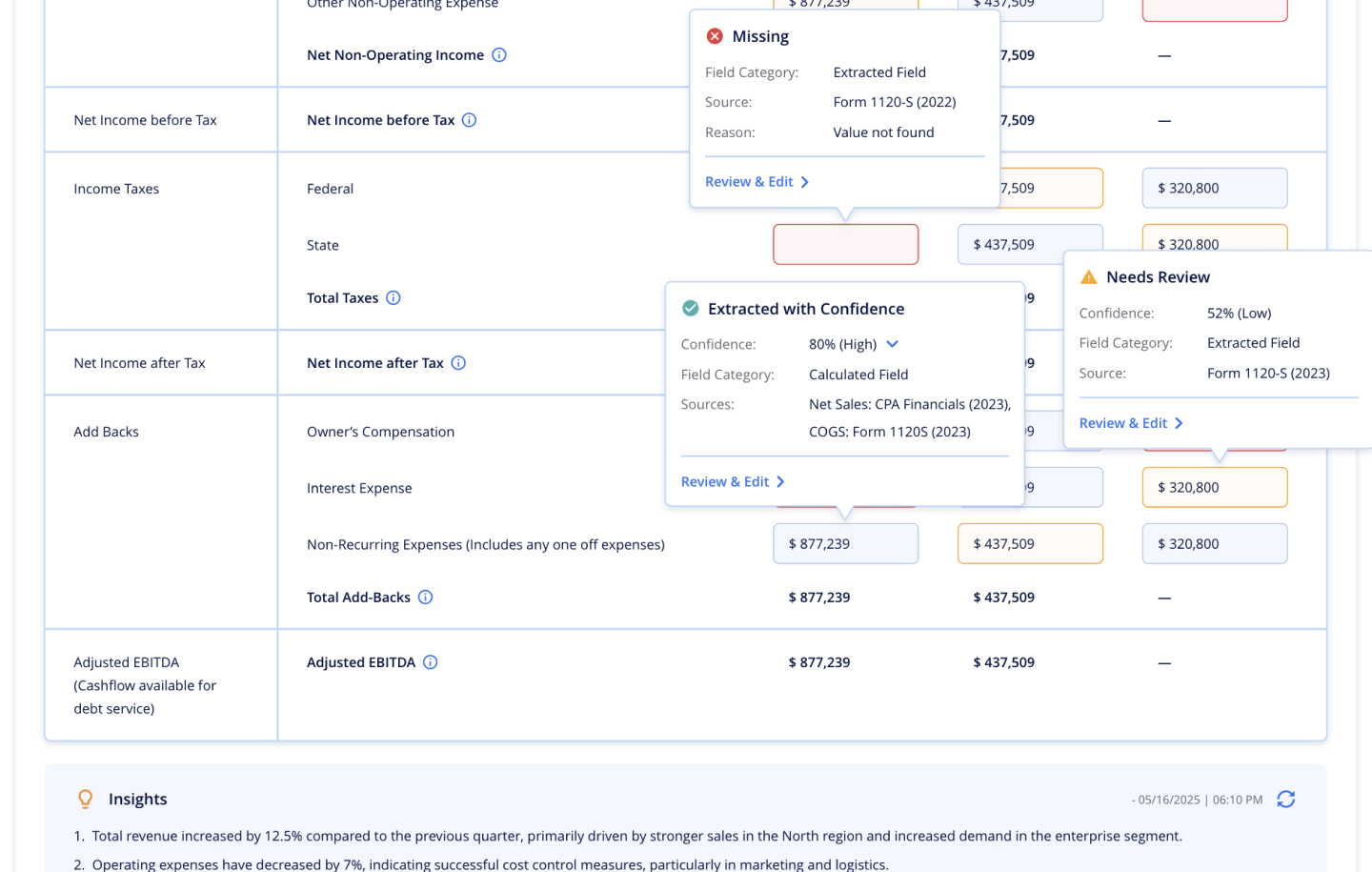

AI-Assisted Underwriting

- The Underwriting Co-Pilot extracts, structures, and analyzes financial data in seconds.

- Confidence scoring highlights where human review is needed.

- Combines AI efficiency with human oversight for fairness and accuracy.

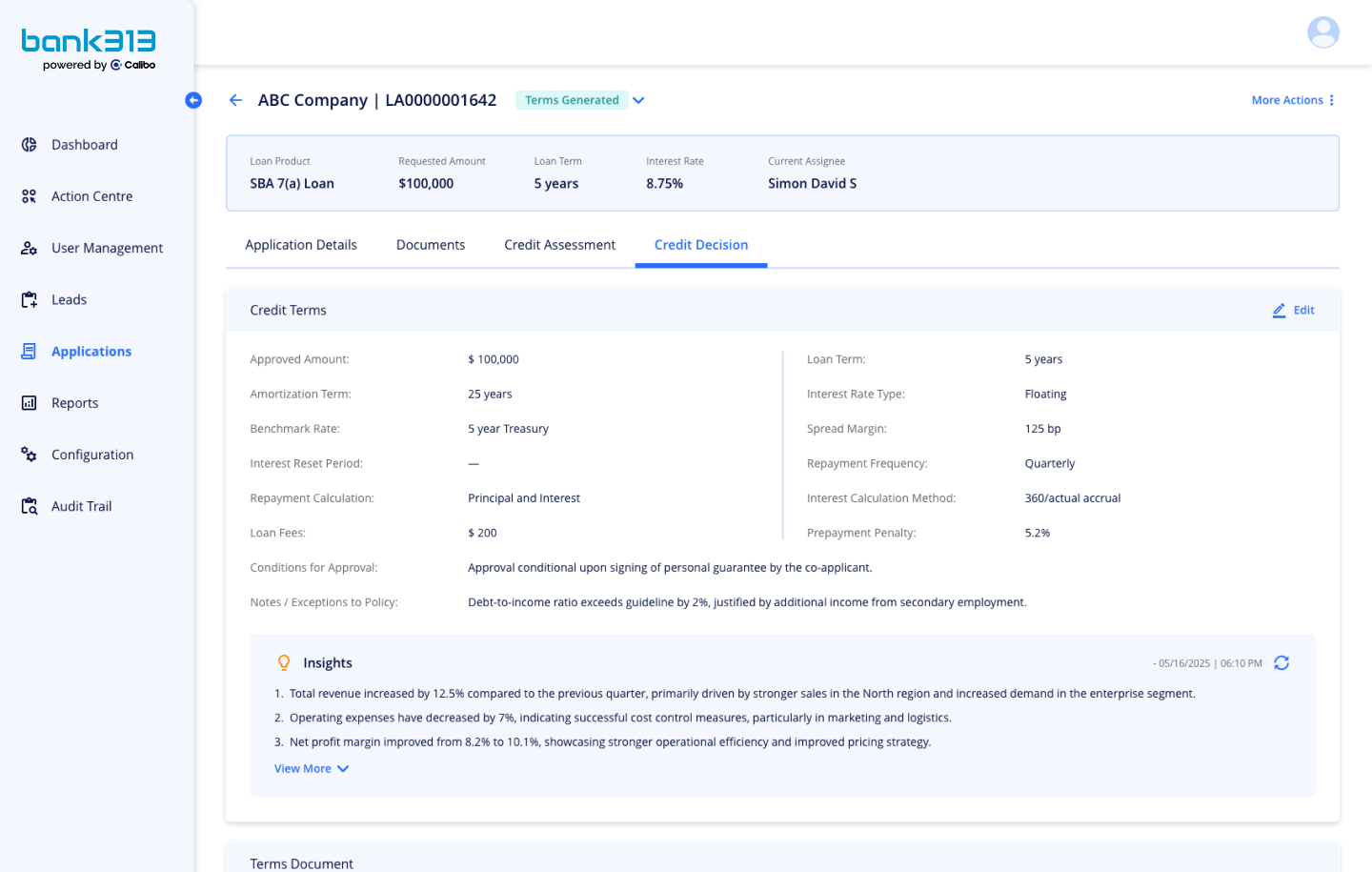

Transparent Decisioning

- Underwriters view explainable AI insights before final approval.

- Full audit trails and policy version control support compliance.

- Role-based access ensures data integrity and governance.

End-to-End Loan Management

- Automates every stage from origination to closing.

- Centralized task tracking and alerts keep teams aligned.

- Integrates with core banking systems for seamless operations.

Built on the Calibo Accelerate Platform — turning complexity into clarity at every step of the lending journey.

Built for Modern Lending

End-to-End Automation

Manages the full lending lifecycle — from lead capture to loan closure — in one place.

AI Underwriting Co-Pilot

Extracts and analyzes financial data in seconds, guiding underwriters with explainable insights.

Governed Data and Security

Bank-grade encryption, audit trails, and role-based controls built into every workflow.

Configurable Workflows

Adapt lending products and approval paths to any market or regulatory need.

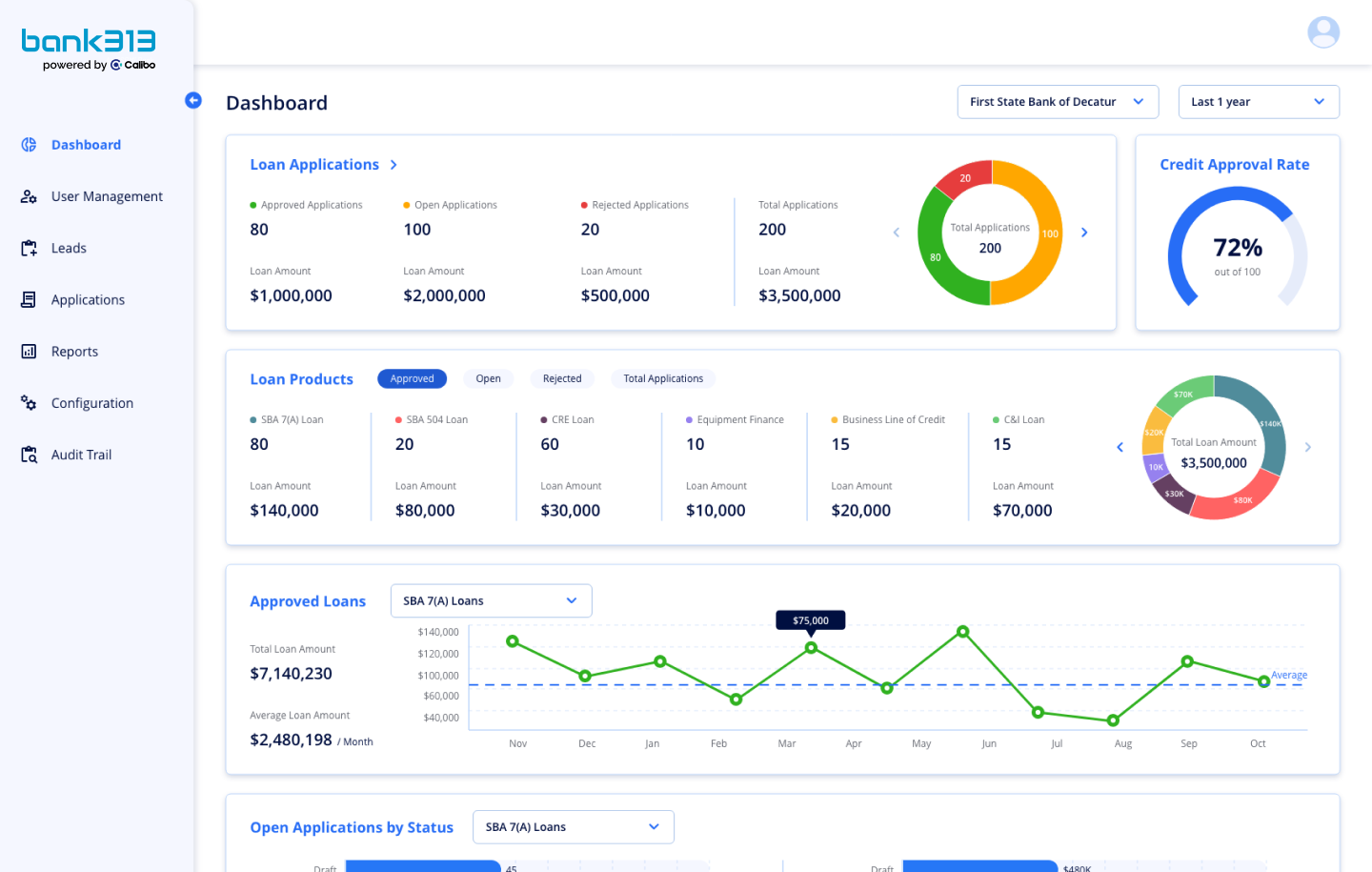

Real-Time Analytics

Dashboards that track applications, approvals, and portfolio trends to inform faster decisions.

Scalable Architecture

Extendable framework ready to support new products and markets — from Detroit to India.

Banking at the speed of Detroit

From Detroit to the World

A story of speed, inclusion, and innovation — transforming how community banks serve small businesses everywhere.

Ready to reimagine digital lending?

Discover how Calibo helps banks and financial institutions accelerate innovation with secure, AI-powered lending solutions.